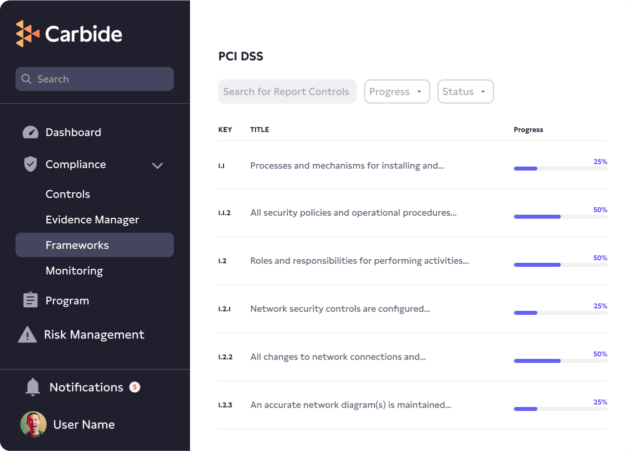

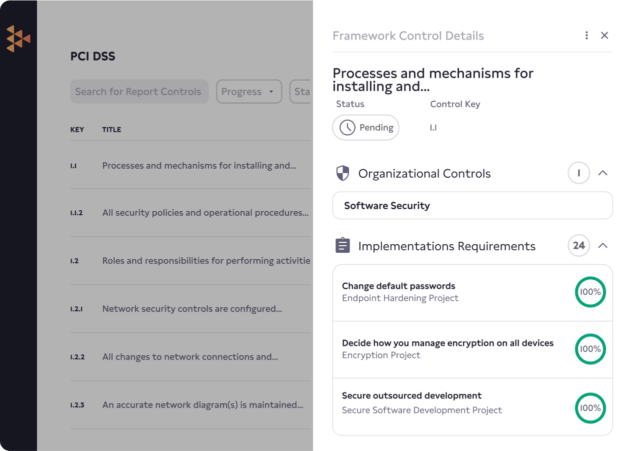

Securing cardholder data is a given if you’re a service provider or retailer who accepts credit and debit card payments. The Payment Card Industry Data Security Standards (PCI DSS) gives you a robust framework to follow — complete with four different levels of compliance and over 300 sub-requirements.

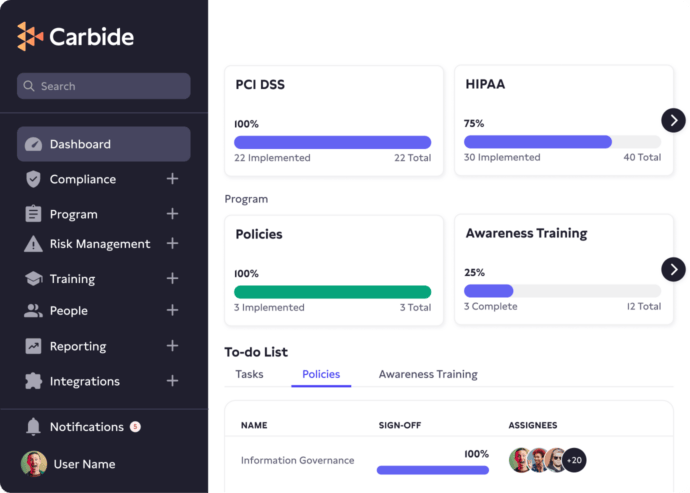

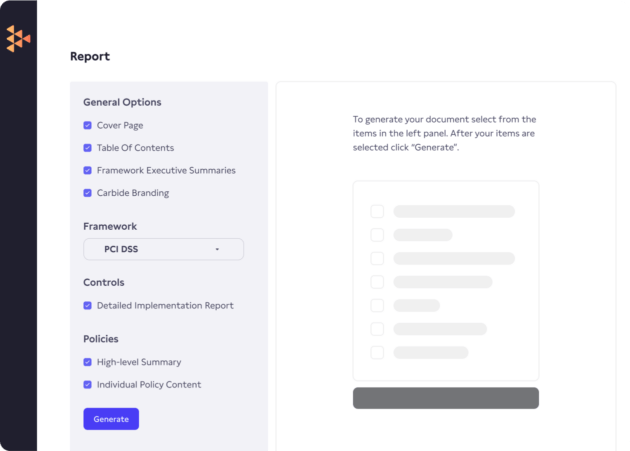

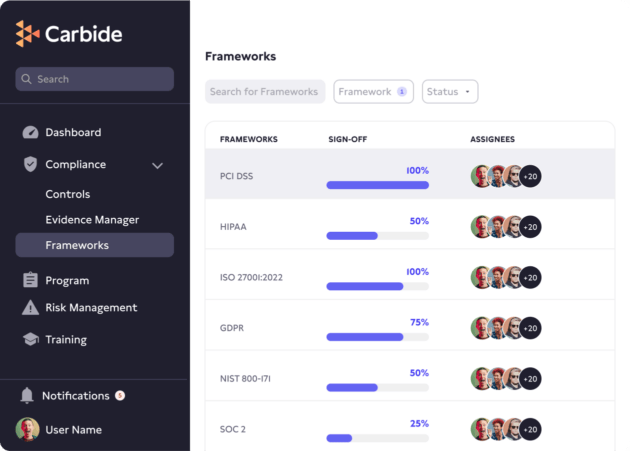

With Carbide, you can leave your checklists and spreadsheets in the past and follow our step-by-step plan to implement PCI DSS information security controls.